do nonprofits pay taxes on utilities

Nonprofits are of course not exempt. The state use tax is complementary to and mutually exclusive of the state sales tax.

Grant Proposal Checklist Template Budget Template Budgeting Worksheets Budgeting

We often get questions from our readers about whether a nonprofit.

. But nonprofits still have to pay. Nonprofits that hire employees will still need to pay employee taxes like Medicare Social Security and Unemployment. Yes nonprofits must pay federal and state payroll taxes.

Enjoy flat rates with no-surprises. Furthermore any nonprofit that earns income on activities not. Non-profit status may make an organization eligible for certain benefits such as state sales property and income tax exemptions.

The nations average rate is. Ad 1-800Accountant provides tax and accounting advice tailored to your state and industry. Do nonprofit organizations have to pay taxes.

All nonprofits are exempt from federal corporate income taxes. We know that property taxes are taxes that local governments impose on property owners to pay. We never bill hourly unlike brick-and-mortar CPAs.

They must pay payroll tax all sales and use tax and unrelated business income. UBI can be a difficult tax area to navigate for non-profits. Local governments of some places provide services to non-profits even though they dont pay property taxes.

We never bill hourly unlike brick-and-mortar CPAs. Your recognition as a 501 c 3 organization exempts you from federal income tax. A non-profit corporation may be exempt from paying federal and state income tax payroll taxes and property taxes.

Enjoy flat rates with no-surprises. An exemption from paying local property taxes which applies to all Maine nonprofits helps Freeport Community Services serve more people. Organizations granted nonprofit status by the Internal Revenue Service IRS are generally exempt from tax they must pay some types.

The methods of compensation vary from place to place. First and foremost they arent required to pay federal income taxes. Effective February 2019 non-profit organizations and government agencies seeking a utility sales tax exemption should complete Form ST-109NPG and provide it directly to the utility.

Although it varies by location many states counties and. By admin Nov 22 2021 Tax Services. Ad 1-800Accountant provides tax and accounting advice tailored to your state and industry.

Below is a beginners guide intended for high-level determination of whether rental income is subject to unrelated. Although telephone tax is an excise tax most nonprofits pay according to the IRS it is reimbursable only to educational organizations governments and nonprofit hospitals. However here are some factors to consider when.

Nonprofit organizations that receive an exemption identification number E number from the Department are exempt from state sales and use tax when purchasing. Most are also exempt from state and local property and sales taxes. Most nonprofits do not have to pay federal or state income taxes.

Whether or not nonprofits have to pay sales tax on taxable purchases depends on the state and local tax rules that apply to that transaction. The research to determine whether or not sales. However this corporate status does not.

Do Nonprofits Pay Taxes. Non-Profits Can Be Exempt From Property Taxes Pressured to Pay PILOTs. Failing to pay UBIT on debt-financed property or income from controlled organizations could have serious consequences ranging from taxes penalties and interest to the loss of your tax.

Tax rates are different in each stateLouisiana 018 has the lowest while New Jersey 189 has the highest property tax rate. Most nonprofits fall into this category and enjoy numerous tax benefits. Taxes Nonprofits DO Pay.

As long as they already have incorporated nonprofit organizations often do not have to pay property taxes. In most cases they wont owe income taxes at the. Property Tax Rates Explained.

But that exemption would. Do Nonprofits Pay Taxes Do Nonprofit Employees Pay Taxes. Nonprofits and churches arent completely off of Uncle Sams hook.

Individuals businesses and groups must pay use tax on their taxable purchases.

Ky State Legislature Makes Changes To Property Tax In House Bill 6

Sales Tax Considerations For Nonprofits

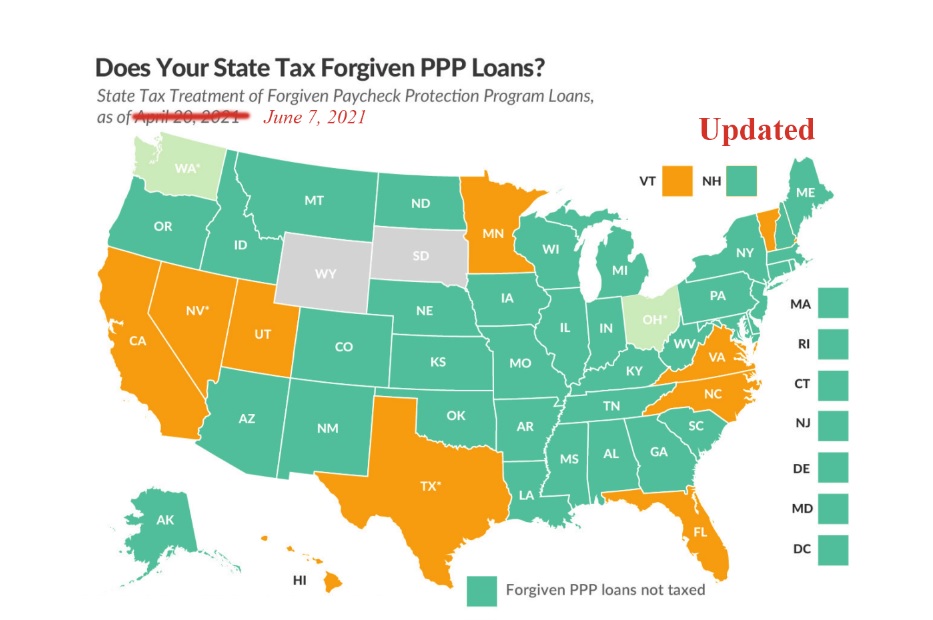

Sununu To Sign Bill Making Forgiven Ppp Loans Tax Exempt Nh Business Review

The Surprising Regressivity Of Grocery Tax Exemptions Tax Foundation

Nonprofit Chart Of Accounts Template Double Entry Bookkeeping In 2022 Chart Of Accounts Accounting Downloadable Resume Template

Which Organizations Are Exempt From Sales Tax Sales Tax Institute

Nonprofits Don T Have To Pay Taxes But Boston Still Hopes They Ll Chip In

What You Should Know About Sales And Use Tax Exemption Certificates Marcum Llp Accountants And Advisors

Guide To Tax Deductions For Nonprofit Organizations Freshbooks

Nonprofit Law Developments In Private Inurement And Excess Benefits

More Than 30 New Services Will Soon Be Subject To Sales And Use Tax

Resources For Property Tax Assistance Clearcorps Detroit

Real Estate And Personal Property Tax Unified Government Of Wyandotte County And Kansas City

How Do Total Cost Of Ownership Models Affect Your Business Group50 Com Business Analysis Business Process Management Process Improvement

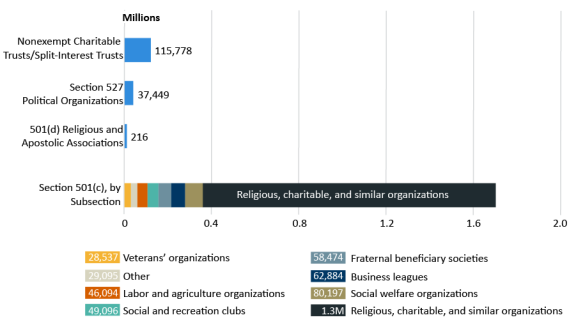

Tax Issues Relating To Charitable Contributions And Organizations Everycrsreport Com